Buy car insurance online

Riding on any vehicle is always associated with various risks, especially there is the probability of a collision with very expensive car. It is for such cases that OSAGO auto insurance is required. It will help to avoid financial costs in the event of unforeseen situations.

Get OSAGO

What is a Car Citizen (OSAGO)?

OSAGO insurance is a form of state protection for people who have suffered as a result of traffic accidents. In fact, it is compulsory insurance of civil liability of vehicle owners. With its help, damage is compensated to persons who suffered damage during an accident. MTPL covers the costs that arise from the culprit of the accident.

The insurer pays:

- Repair of the damaged machine;

- Treatment of the driver and passengers;

- Restoration of damaged property of third parties (fence, wall of the house and other real estate).

Most people call a policy for motor third party liability insurance. It must be emphasized once again that this type of insurance is mandatory. It is forbidden to drive a car without insurance. In addition, with its help, you can get reimbursement even if as a result of an accident you have suffered damage, but the person who has the OSAGO does not. Insurance is valid for a period of 15 days to 1 year.

What are the auto citizens?

Online policy

Online auto insurance is the most optimal way to protect yourself from serious material costs in the event of a traffic accident. The document has exactly the same legal force as conventional insurance. After paying the full cost, the policy will be sent to you in e-mail in PDF format. It will be recorded in the MTIBU database and checked by the police. You can check the validity of the policy by car license plate or insurance number on the MTIBU website.

Regular (paper) insurance

This is a traditional option when you visit an office. Its advantage is that an employee of the insurance company will be able to tell as much as possible about the features of the policy. At the same time, managers are interested in selling you a premium product, offering additional services. In addition, the procedure itself can take a lot of time (especially if there is no suitable office nearby).

Advantages of an online policy over a regular one

Time saving

You do not need to visit the branch of a suitable insurance company, and then wait until the policy is prepared. The whole procedure takes only a few minutes, a PDF document will be sent to the mail immediately after payment

Affordable cost

Using online resources, you will not only not pay the cost of delivery, but also save up to 10% on the price of the policy itself

Guarantee of authenticity

It is not possible to fake electronic insurance. In addition, it is impossible to lose such a policy - it will always be on your computer, tablet or phone

Online policy from Arsenal Insurance and iPay.ua. What are the benefits?

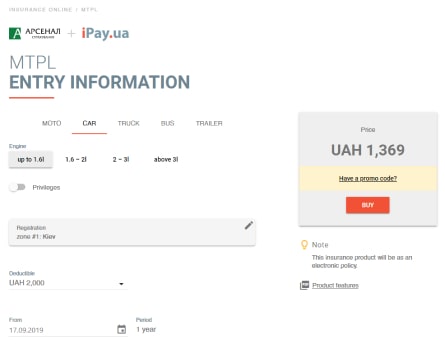

Most recently, the resource for online transactions iPay.ua, as well as IC Arsenal-Insurance, launched the OSAGO purchase service via the Internet. The main advantage of such a proposal is the maximum speed of obtaining a policy. You will receive the necessary document immediately after payment. At the same time, there is no need for the car owner to prepare any papers. Electronic insurance is possible for owners of any vehicles, including motorbikes, cars and trucks, buses, trailers. There are various insurance products for cars with any engine volume. iPay.ua is the first online resource in our country that allows you to take out OSAGO and calculate insurance online while sitting in front of a computer monitor or smartphone screen!

How to get OSAGO online?

The main advantage of online insurance is the fact that the procedure requires a minimum of effort and time from the vehicle owner. To draw up a policy, the owner does not need to prepare any paper documents. You just need to visit the site iPay.ua, select the category Insurance-CTP, and then enter the following information:

- Type of vehicle;

- Engine volume;

- Availability of a preferential category;

- Place of registration of a car;

- Franchise amount (the amount of funds that are covered at the expense of the car owner);

- The beginning and period of validity of the policy.

After that, the online calculator will calculate the cost of the service, and you just need to enter information about yourself and the car, and then pay for the policy. After a couple of minutes, an e-mail with an electronic document will be sent to your e-mail, which can be used in case of unforeseen situations.

What documents are needed in order to issue OSAGO online?

Certificate of registration of the vehicle (technical passport)

Driver’s

license

Passport and TIN

If the policyholder belongs to the preferential category, a document that confirms this fact

What determines the cost of insurance?

- The place where the car is registered;

- Power of a power unit of a car (engine volume);

- Driving experience;

- Insurance validity period;

- The size of the deductible (the smaller the greater the final cost).

- It is also worth noting that some categories of people, including pensioners, people with disabilities, war veterans and Chernobyl victims are given a 50 percent discount.

What to do in case of an accident?

In the event of an insured event (accident), it is necessary, first of all, to act in accordance with the rules of the road. If there are no victims, you should immediately call the operator of the insurance company - he will coordinate your actions. You should also call the employees of the National Police or arrange the event through Europrotocol. It is necessary to file a claim for damages to the insurance company within three business days after the accident.

In addition, you should adhere to a number of general recommendations:

- Write down the contact details of all participants in the insured event;

- Take the necessary measures to reduce losses;

- Take a photo or video of the scene of the accident;

- Do not repair the car before it is inspected by a representative of the insurance company.

How to recover the damage?

The insurance company must compensate the damage that was caused to the injured person as a result of the accident. At the same time, not only the driver, but all passengers are considered victims. The damage caused to the property of the victims is also compensated (first of all, we are talking about a vehicle). The maximum insurance amount is 100 thousand UAH. for damage to health and 50 thousand UAH. for damaged property for each victim as a result of an accident. The insurer must pay the amount from 15 to 90 days after filing the documents. In case of delay, a penalty may be charged.

How to use an electronic insurance policy?

An electronic policy is a completely legal document that allows you to rely on the same rights as with a regular paper version. The police have no right to fine owners who have taken out insurance online. Printing a document is not necessary - just show it on the screen of your tablet or smartphone. Law enforcement agencies should not have any difficulties with checking it - all information about him is in the MTIBU database.

Get OSAGOMTPL online policy is the best choice for all car owners

All car owners need to take out liability insurance without fail. But now there is no need to go to the IC department, it is better to do everything online. It is faster, more convenient and cheaper. Moreover, the legal force of such a policy is exactly the same as that of the paper version. You can issue OSAGO via the Internet on the site iPay.ua.